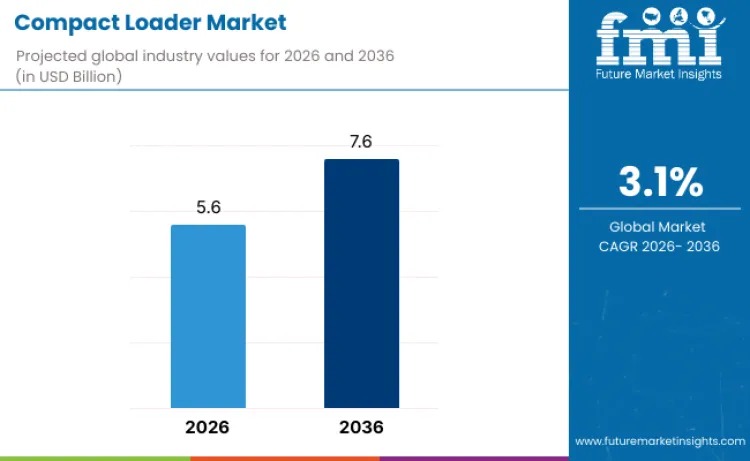

The compact loader market records USD 5.6 billion in 2026 and reaches USD 7.6 billion by 2036 at 3.1% CAGR.

NEWARK, DE, UNITED STATES, February 2, 2026 /EINPresswire.com/ — The global compact loader market is valued at USD 5.6 billion in 2026 and is projected to reach USD 7.6 billion by 2036, growing at a CAGR of 3.1%. This sector is defined by a shift toward high-efficiency, multi-functional machines that thrive where larger equipment cannot—specifically in dense urban construction, interior demolition, and precision landscaping.

Dominant Segments and Applications

Compact Track Loaders (CTLs): The Leading Product Type

With a 38.5% market share, CTLs are the preferred choice for modern contractors. Unlike traditional wheeled skid steers, CTLs utilize a rubber track system that offers:

• Superior Traction: Essential for soft, muddy, or uneven terrains common in early-stage residential development.

• Low Ground Pressure: Minimizes surface damage, making them ideal for high-end landscaping and sensitive agricultural sites.

• Stability: The wider footprint allows for better lifting capacity and smoother operation on slopes.

Request For Sample Report | Customize Report | Purchase Full Report

https://www.futuremarketinsights.com/reports/sample/rep-gb-5846

Construction: The Primary Demand Driver

Accounting for 45.9% of total demand, the construction sector relies on compact loaders for “last-mile” site work. As urban areas become more congested, the ability to maneuver a machine through narrow alleys or inside building frames is a competitive necessity. Beyond simple excavation, these machines serve as universal tool carriers for augers, trenchers, and hydraulic hammers.

Regional Performance & Growth Forecast (2026–2036)

Between 2026 and 2036, the compact loader market will exhibit distinct growth trajectories shaped by local economic priorities and technological adoption. Australia is set to lead with a 5.0% CAGR, propelled by massive investments in urban residential expansion and critical infrastructure supporting its mining-adjacent regions. China follows with a 4.6% CAGR, as high-density urban renewal projects and aggressive agricultural mechanization programs drive the need for versatile, space-efficient machinery. In India, a 4.5% CAGR is expected, fueled by the national “Smart Cities” initiatives and a growing emphasis on modernizing municipal waste management and road maintenance services.

In more mature markets, the focus shifts toward sustainability and service models. Germany is projected to grow at 3.1% as the industry pivots toward electric loader fleets to meet strict noise and emission standards, particularly for precision landscaping in affluent suburban zones. Meanwhile, the United States will maintain a steady 2.2% CAGR, sustained by a robust rental market that allows contractors to access the latest equipment on-demand for professional landscaping, forestry, and high-frequency residential renovation projects.

Future Trends: Electrification and Intelligence

The next decade will see the compact loader market transition from purely mechanical to highly “intelligent” machines.

• The Electric Pivot: By 2026, electric compact loaders are no longer niche. Zero-emission machines are now mandatory for indoor demolition and nighttime municipal work in many European and North American cities. These models offer lower total cost of ownership (TCO) due to fewer moving parts and reduced fuel expenses.

• Telematics & Automation: Integration of GPS and IoT sensors allows fleet managers to track fuel efficiency, geofence equipment, and perform predictive maintenance. Semi-autonomous features, such as “return-to-dig” and automated grade control, are becoming standard, helping to mitigate the global shortage of skilled operators.

• Attachment Versatility: Manufacturers are focusing on “plug-and-play” hydraulic systems that allow a single machine to transition between dozens of attachments in seconds, maximizing the utility of a single capital investment.

Competitive Landscape

The market is highly concentrated among established giants and specialized innovators.

• Caterpillar Inc. & Deere & Company: Leverage vast dealer networks and high-durability designs to maintain dominance in North America.

• Bobcat (Doosan): Remains a synonymous name for compact loaders, particularly strong in the rental and landscaping segments.

• Kubota & Yanmar: Lead the way in sub-compact and high-efficiency diesel engines, with a strong foothold in the agricultural and small-contractor markets.

• XCMG & Sany: Rapidly expanding their global footprint by offering cost-effective, high-performance alternatives in emerging markets.

Industry Note: The Rental Market is a critical auxiliary driver. Approximately 35-40% of compact loaders are now funneled through rental channels, as small contractors prefer the flexibility of “on-demand” equipment over the long-term liability of ownership.

Similar Industry Reports

Compact Wheel Loaders Market

https://www.futuremarketinsights.com/reports/compact-wheel-loaders-market

Canada Compact Wheel Loader Industry Analysis

https://www.futuremarketinsights.com/reports/compact-wheel-loader-industry-analysis-in-canada

Compact Track and Multi-Terrain Loader Market

https://www.futuremarketinsights.com/reports/compact-track-and-multi-terrain-loader-market

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()